A portion of the difference in property guarantee mortgage and you may a home improve mortgage is the access to equity, however, there are reduced facts well worth discovering. These records you will dictate the decision since you find the best way to financing your property renovation enterprise.

How borrowing from the bank amounts have decided

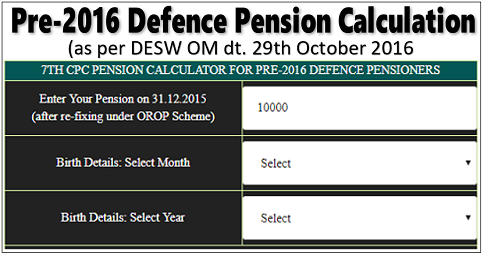

To own an FHA Label We mortgage, the maximum a loan provider can be grant you is $twenty five,000, and is on condition that you own just one-home or a made house (one home-built in an enthusiastic offsite plant then gone so you’re able to their latest place) one qualifies since property. The principles having classifying a created domestic since the real-estate are very different because of the state, but generally speaking it indicates the house must have a long-term venue, has actually its wheels and you can chassis eliminated, be connected to a foundation and be linked to local utilities.

Are available property that do not meet the county conditions the real deal assets are classified as private assets. Probably the most you might located having a made domestic qualifying since the private home is $seven,five hundred. You may receive around $a dozen,000 per unit for folks who very own homes for the a good multifamily building.

It’s really worth listing you to definitely HUD doesn’t have one credit rating or income criteria for those fund. not, individual loan providers will get criteria you are going to need to see to remain qualified.

By firmly taking aside a personal loan to pay for domestic improvement can cost you, extent you might use utilizes the financial institution, your credit rating and your income. Normally, loan providers would not enable you to obtain over $100,000 unless you support the financial obligation with a few sort of collateral.

Once the property collateral mortgage uses your property due to the fact equity, you might borrow so much more, depending on how much household collateral you have gathered. Within this scenario, certain lenders makes it possible to use as much as 80% of one’s home’s appraised really worth, that could potentially leave you with high financing to complete the restoration.

Duration of repayment terms

Payment terms can differ somewhat, according to the sorts of do-it-yourself mortgage you obtain. The lender often normally explanation the payment terms and conditions when you signal new arrangement, but definitely do your own look ahead.

Having an enthusiastic FHA Label We loan, loan online Texas maximum title is actually twenty years and you can thirty two months having a single-relatives property otherwise flat, fifteen years and you will thirty two months for a produced household one qualifies as the real property and you will a dozen age and you may thirty-two weeks getting an excellent possessions upgrade loan to own a created household classified once the private assets.

The bank will set the brand new fees plan to have a personal do it yourself loan, depending on the matter you acquire. Alternatively, property collateral loan typically includes a fees label out of four, 10 or 15 years, and you will create monthly payments as you create that have a mortgage.

Prospective taxation positives

Home improvement finance you should never provide one head taxation experts. Yet not, you could potentially deduct any desire you pay into a house security loan having loans used to alter your family. You need to support the financing utilizing your head household or second accredited home to discover that it deduction, and you’ll you prefer an itemized taxation return.

Shielded otherwise personal loan

Your own do it yourself loan was an unsecured monetary device, which could limit the count lenders gives. An enthusiastic FHA Identity I loan is generally unsecured doing $7,five hundred, however, security in the form of your own home’s mortgage or action was very important to numbers anywhere between $seven,501 and you may $25,000.

A home security loan was protected from the equity you’ve mainly based of your property. This is why, you reside the fresh new guarantee, so you could cure it if not pay-off the bucks with respect to the lender’s conditions.